Financial System Report (October 2023)

October 20, 2023

Bank of Japan

Motivations behind the October 2023 issue

This issue of the Report focuses on various risk-taking behaviors that lie behind financial intermediation activities and assesses the resilience of and potential vulnerabilities in Japan's financial system by analyzing them from the following two perspectives.

First, the Report thoroughly examines banks' interest rate risk. Interest rate risk is a fundamental risk for banks, which engage in maturity transformation. The significance of managing such risk has been highlighted by the U.S. bank failures in March 2023. In Japan, banks' interest rate risk has also increased under the prolonged low interest rate environment. With a view to sophisticating risk management, it is essential to deepen understanding of the mechanism in which interest rate risk could materialize due to interest rate fluctuations.

Second, the Report examines potential credit risk posed to banks. The quality of banks' loan portfolios has been maintained to date, even with an increase in corporate bankruptcies. However, with global financial conditions continuing to tighten, borrower firms' financial conditions could deteriorate due to the cumulative rise in various input/funding costs and a slowdown in the global economy. Moreover, banks' exposure to real estate businesses has been expanding at home and abroad. Against this background, it is important to accurately assess changes in their credit risk profiles.

Executive summary: Stability assessment of Japan's financial system*

Japan's financial system has been maintaining stability on the whole. Japanese banks have sufficient capital bases to perform financial intermediation activities appropriately even amid the global tightening of financial conditions and the resultant various types of stress. They also have stable funding bases, especially small, sticky retail deposits. Even after uncertainty over the financial sectors in the United States and Europe heightened in March 2023, Japan's financial system has been sound and resilient.

However, vigilance against tail risks continues to be warranted. The period of stress may be prolonged further with continuing monetary tightening by central banks and the resultant concerns about a slowdown in foreign economies. Uncertainty about future developments is similarly noted in financial and capital markets. From a long-term perspective, if banks' core profitability were to stagnate and capital accumulation were to stall, financial intermediation could be impaired due to a decline in loss-absorbing capacity, or vulnerabilities in the financial system could increase through excessive search for yield. To ensure the stability of Japan's financial system, it is necessary to examine these risks of contraction and overheating in the financial system and address potential vulnerabilities appropriately.

Financial cycle and interest rate risk

- Chapters III-C,

- IV-C,

- and Box 2

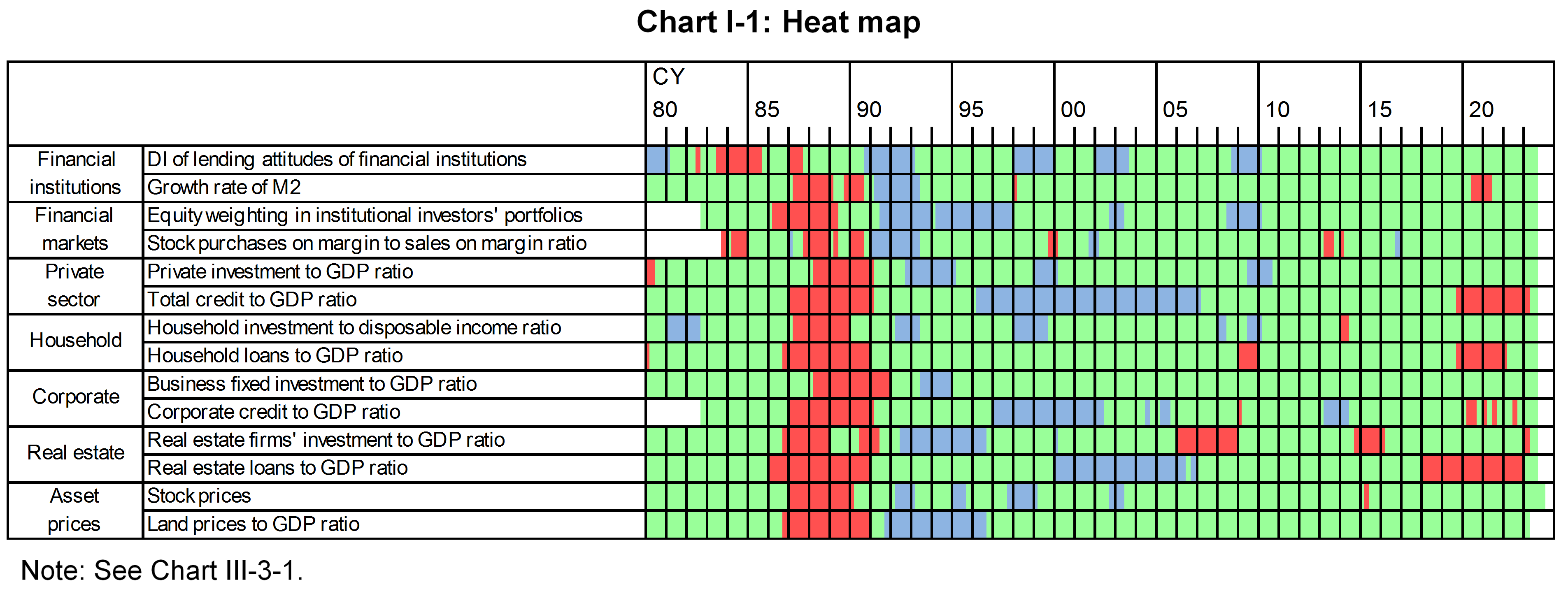

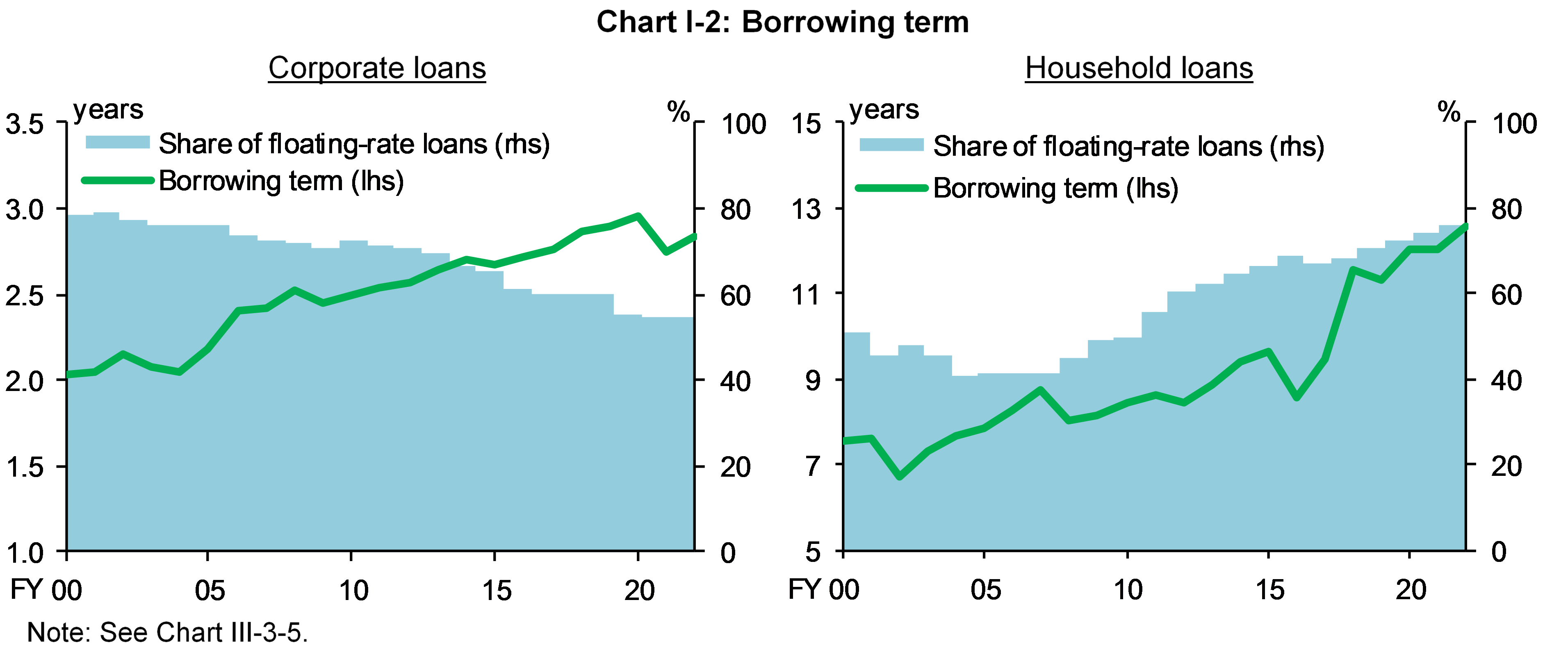

No major financial imbalances can be observed in current financial activities (Chart I-1). The large increase in private debt since the outbreak of the pandemic is due to cautious cash management, especially by small and medium-sized enterprises (SMEs), aimed at securing ample cash reserves. However, in the medium to longer term, borrowing terms for corporate and household loans have become longer with the increase in private debt (Chart I-2). Firms have secured stable funding at long-term fixed interest rates and contained refinancing risk, seizing an opportunity from the decline in long-term interest rates. Households have reduced their monthly repayment burden for large-lot housing loans through long-term floating-rate loans at low interest rates.

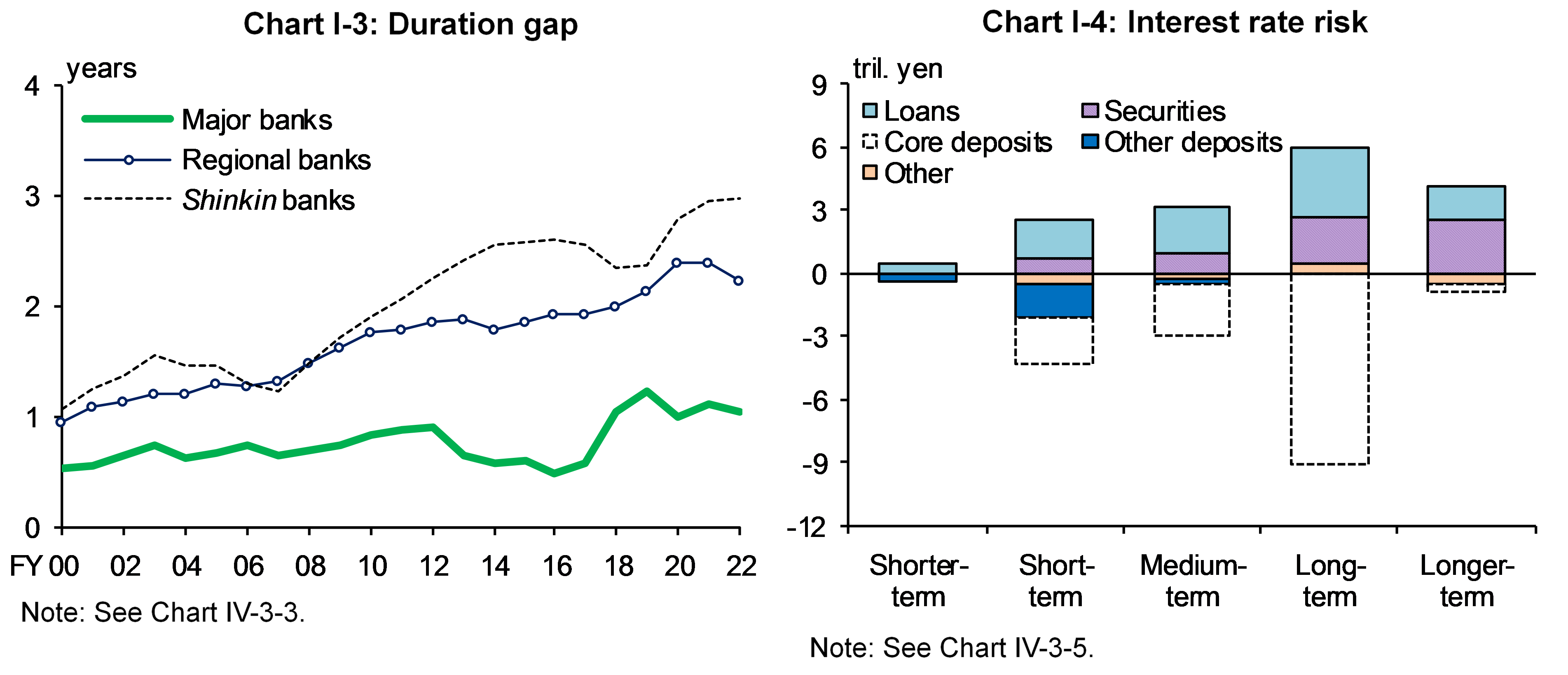

Reflecting the longer borrowing terms, banks' duration gap -- the difference between repricing schedules of interest payment for assets and liabilities (not taking core deposits into account) -- has widened compared to a decade ago (Chart I-3). At major banks, this is due to the increase in long-term fixed-rate loans. At regional and shinkin banks, changes in lending, as well as the shift to investments in long-term bonds in their securities investment, have led to the widening of the gap. The longer durations on the asset side and resultant increase in the amount of interest rate risk are offset by core deposits (Chart I-4). Looking at banks as a whole, 100 BPV interest rate risk, taking core deposits into account, is generally in balance between assets and liabilities. Banks need to maintain the loss-absorbing capacity to cope with the interest rate risk, as well as manage risk more prudently as the duration gap has become wider than in the past.

Financial cycle and the real estate market

- Chapters III-A,

- III-C,

- and Box 1

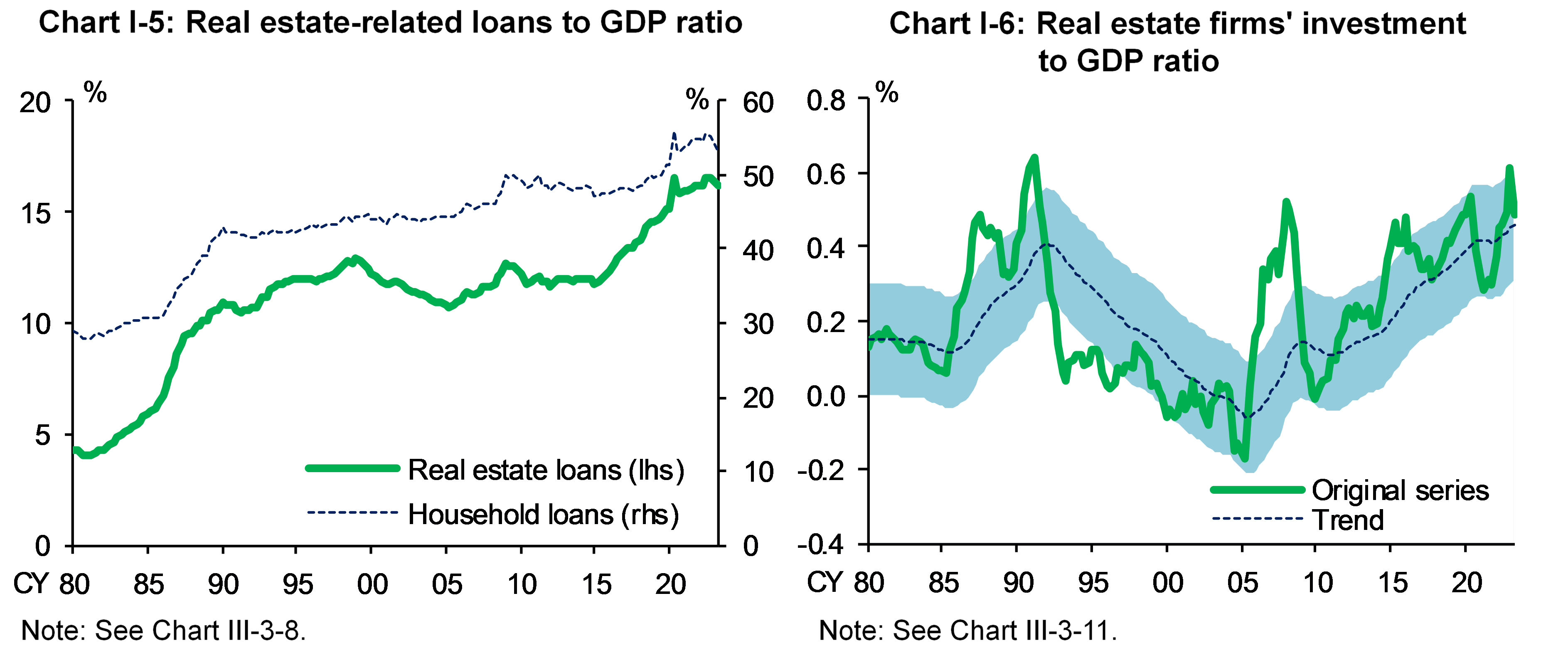

In the financial cycle, the rebalancing of private debt and economic activity has continued as the economy has recovered. Even against this background, real estate loans have continued to increase (Chart I-5). In the real estate transaction market, there continues to be demand for funds, mainly by foreign investors. In the real estate leasing market, the rise in investment in fixed assets by real estate leasing businesses and the corresponding increase in lending by regional banks have continued. Real estate-related loans, such as loans to real estate businesses and housing loans, have contributed to some degree to the trending longer borrowing terms mentioned earlier (Chart I-2).

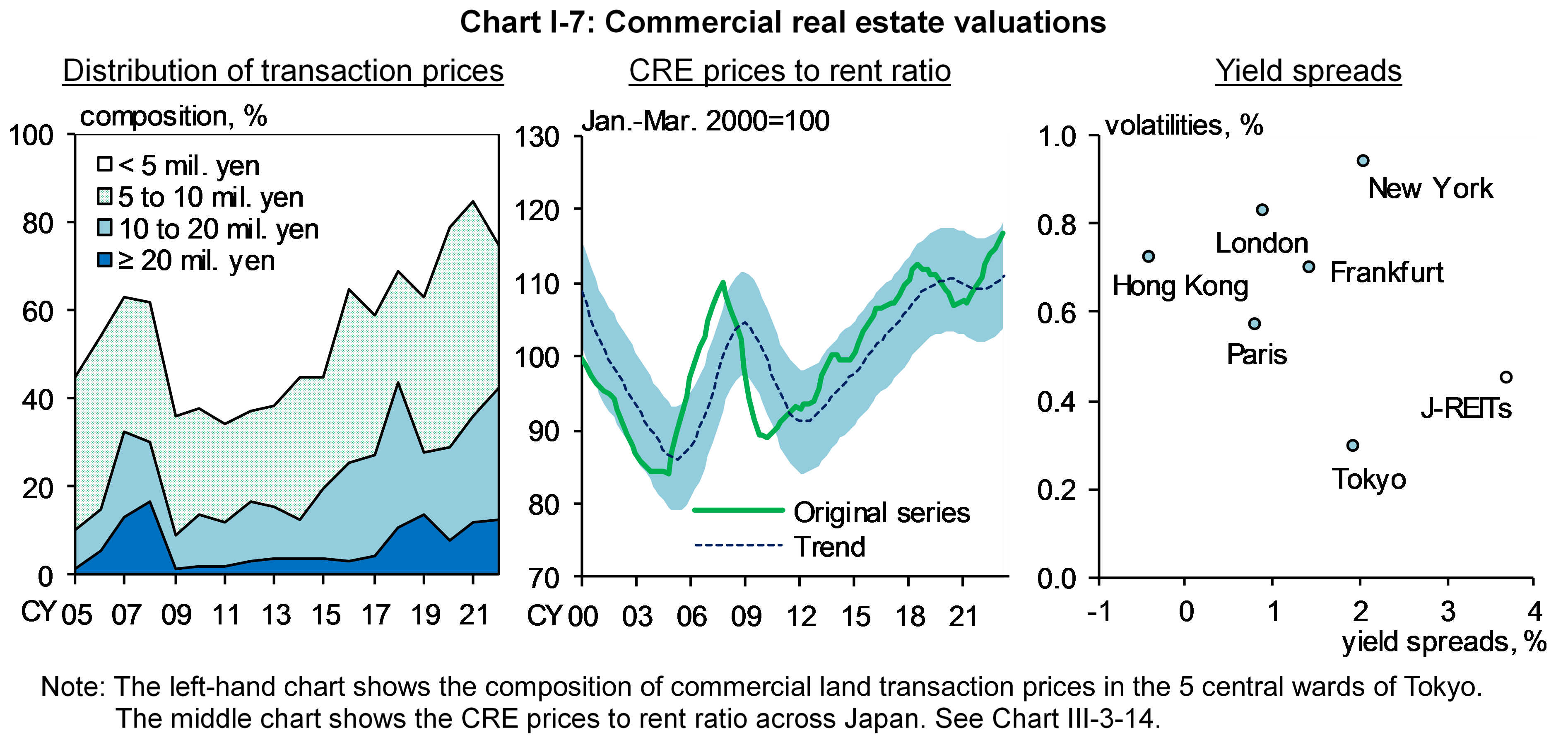

In the real estate transaction market, changes can be seen in not only liabilities but also assets of real estate businesses, as well as in real estate prices. On the asset side, the real estate firms' investment to GDP ratio temporarily turned "red" in the heat map, which signals overheating (Chart I-6).1 The increase in real estate firms' investment has been accelerated by urban redevelopment projects by major real estate developers. In terms of prices, valuations of some properties seem relatively high (Chart I-7). Land prices have shown only small fluctuations across Japan, but in some limited commercial areas in central Tokyo, transactions in the higher price range have been increasing. The commercial real estate prices to rent ratio in Japan as a whole has been above the level seen in the mini-bubble period in the late 2000s. Developments in the real estate transaction market continue to warrant close monitoring.

Increased corporate bankruptcies and banks' credit risk

- Chapters III-A

- and IV-A

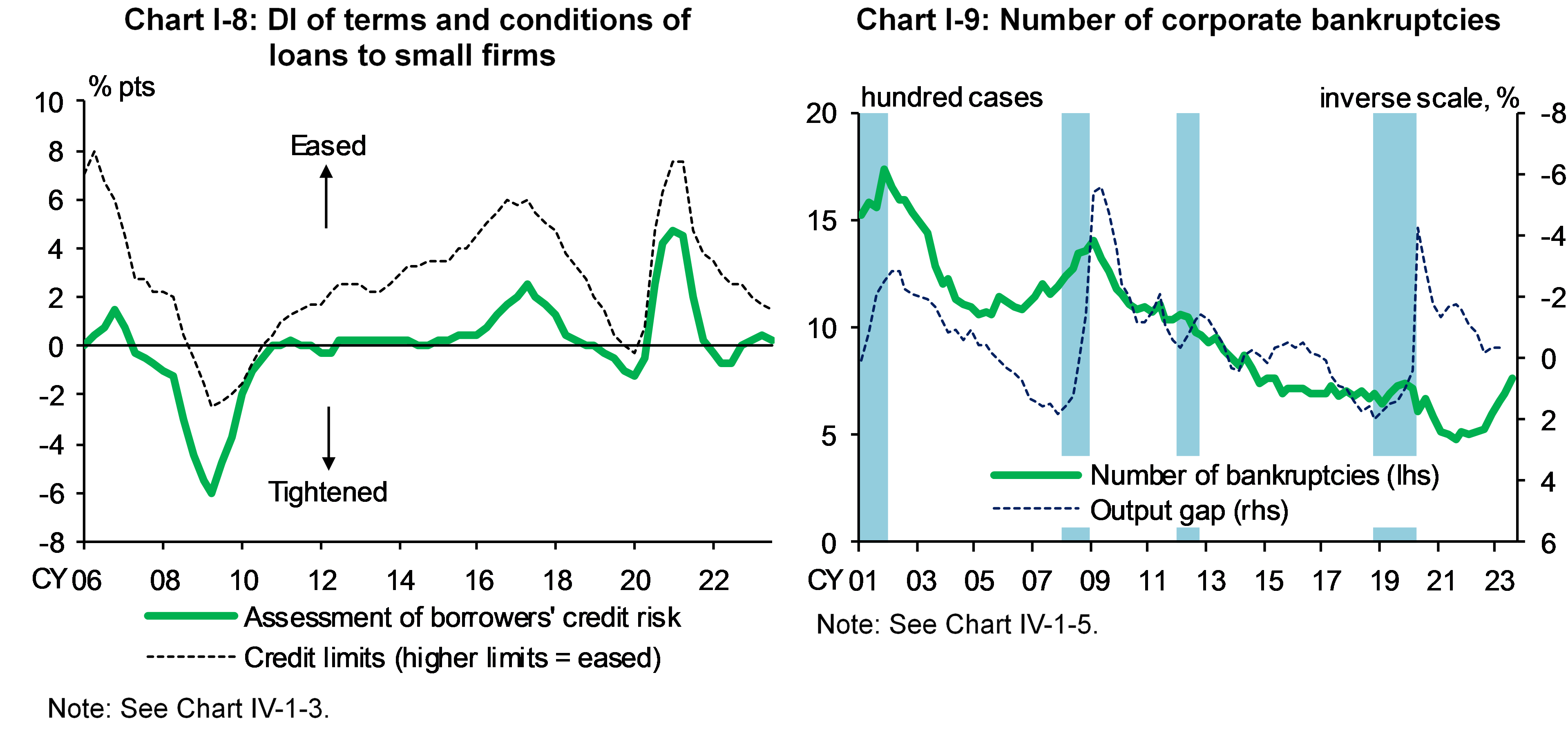

Banks' domestic lending stance has remained active even with firms facing a variety of stresses. Looking at banks' loan conditions, there has been no sustained tightening in the risk assessment of loans to small firms (Chart I-8). Credit lines for small firms remain elevated. Despite these accommodative financial conditions, bankruptcies of firms have been on the rise since the end of last year (Chart I-9). Firms' defaults, although at a low level on the whole, have been rising, particularly for small-sized firms.

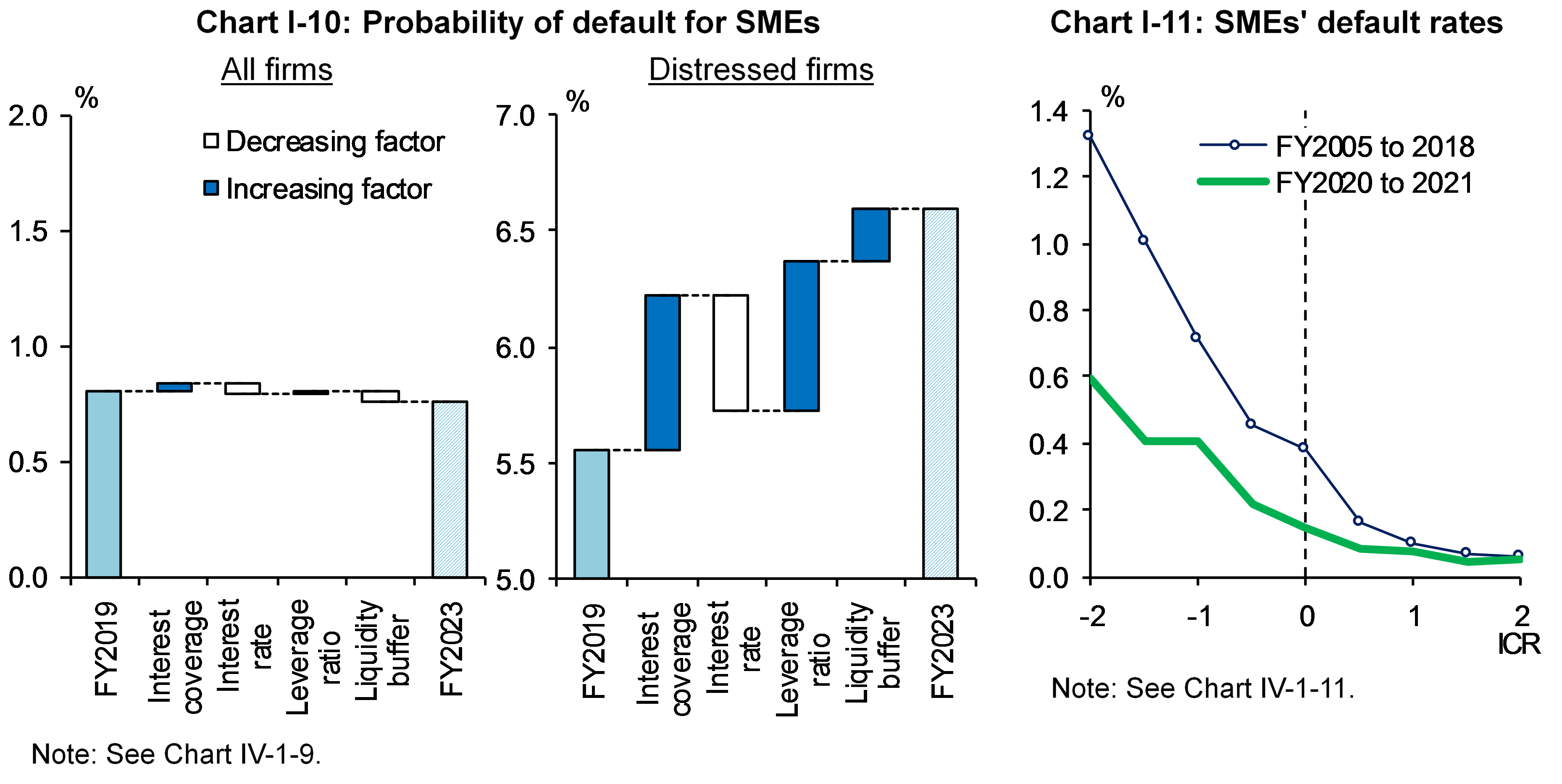

Chart I-10 shows the probability of default estimates for SMEs and the factors behind changes in the probability. For SMEs as a whole, there is no significant difference between the probability of default just before the pandemic and most recently. The increase in the liquidity buffer due to pandemic-related loans and various subsidies restrains defaults. In contrast, for distressed firms, which have experienced a deterioration in their business since before the pandemic, interest payment burden, leverage ratios, and the decline in liquidity buffers push up the probability of default. This suggests that their liquidity buffer has continued to decline and that its effectiveness in curbing defaults has been weakening. The actual default rate in recent years has been pushed down substantially by the strong corporate financing support measures since the outbreak of the pandemic (Chart I-11). With economic activity returning to normal, the default rate is expected to return to its through-the-cycle average.

Banks' resilience against higher foreign interest rates

- Chapters II-C,

- IV-A,

- IV-B,

- IV-D,

- and V-B

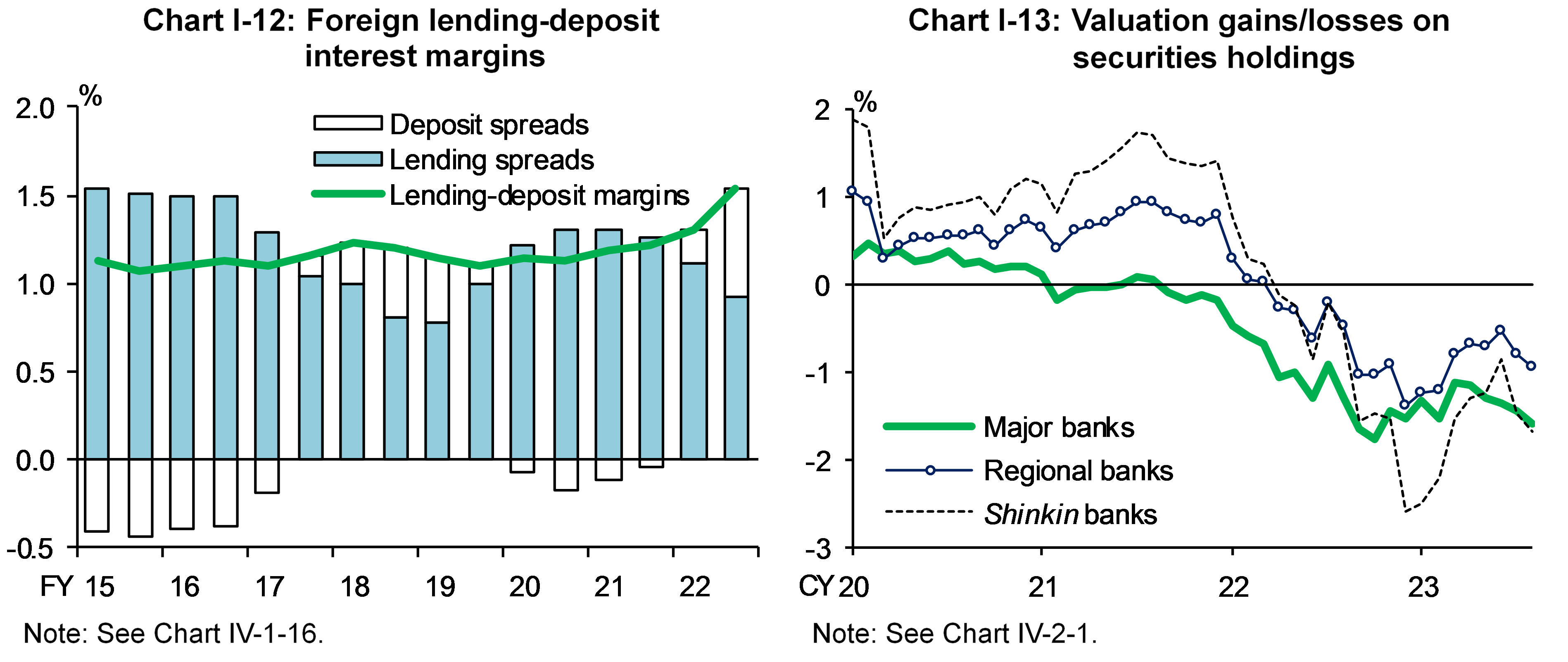

Looking at banks' foreign currency portfolios, credit risk of foreign loans has been kept low even amid the global tightening of financial conditions. Foreign lending-deposit interest margins have continued to improve together with the rise in market interest rates, leading to an improvement in profit buffers, which represent one element of banks' loss-absorbing capacity (Chart I-12). In terms of securities investment, the increase in banks' valuation losses on securities, especially foreign bonds, has been limited compared to the beginning of this year (Chart I-13). In particular, banks that have actively rebalanced have reconfigured their portfolios, increasing their holdings of bonds with higher yields and shorter average durations. At the same time, these banks have strengthened their hedging against the risk of higher interest rates.

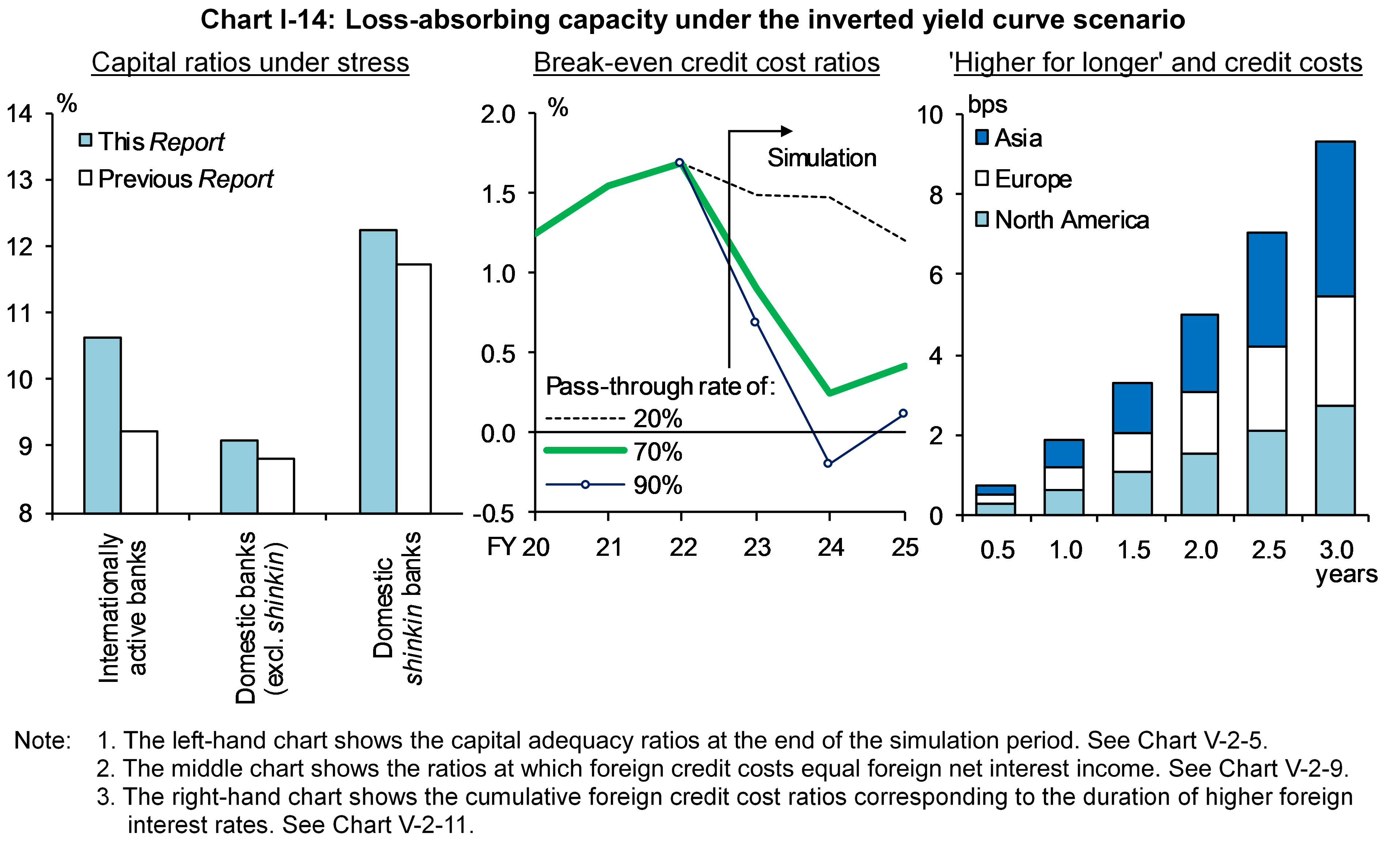

The impact of the rebalancing of foreign currency portfolios can also be seen in the results of the macro stress testing. Banks are more resilient against the stress of foreign yield curves remaining inverted for a long time, compared to the simulation results in the previous Report. For all types of banks, capital adequacy ratios in the event of stress are higher than in the previous Report (left panel of Chart I-14). The share of banks for which room for realizing gains (net valuation gains/losses on securities holdings) turns negative has declined from 80 percent in the previous Report to close to 50 percent in this Report.

It should be noted that there remain downside risks to loss-absorbing capacity during the simulation period. If there is additional stress on the foreign currency deposit market and the interest rate pass-through to deposit funding rises above the historical average of 70 percent, the break-even credit cost ratio at the end of the rising interest rates phase will be negative (middle panel of Chart I-14). This means that banks cannot absorb foreign credit costs through foreign net interest income. In order to both reduce funding liquidity risk and ensure sufficient loss-absorbing capacity, it is important for banks to secure stickier deposits. Moreover, a situation of foreign interest rates remaining higher for longer leads to a deterioration not only in banks' but also firms' financial conditions. For loans to North America, Europe, and Asia, credit cost ratios increase non-linearly with higher interest rates staying for longer (right panel of Chart I-14). Such credit risks are pronounced in loans to Asia, where firms with high financial leverage and low interest coverage ratios (ICRs) are concentrated.

The Bank of Japan will promote financial institutions' initiatives to address these potential vulnerabilities through on-site examinations and off-site monitoring. It will continue to closely monitor the impact of various risk-taking moves by financial institutions on the financial system from a macroprudential perspective.

- See the Report for more details on the analyses as well as notes and sources of the charts. Return to text

- 1In Chart I-6, when an index exceeds its upper threshold (shaded area in the chart), it turns "red" in the heat map, which signals overheating. Return to text

Notice

This Report basically uses data available as of end-September 2023.

Please contact the Financial System and Bank Examination Department at the e-mail address below to request permission in advance when reproducing or copying the contents of this Report for commercial purposes.

Please credit the source when quoting, reproducing, or copying the contents of this Report for non-commercial purposes.

With regard to economic and financial variables of each stress scenario in the macro stress testing, please see the scenario tables [XLSX 38KB] .