Highlights of the Outlook for Economic Activity and Prices (January 2023)

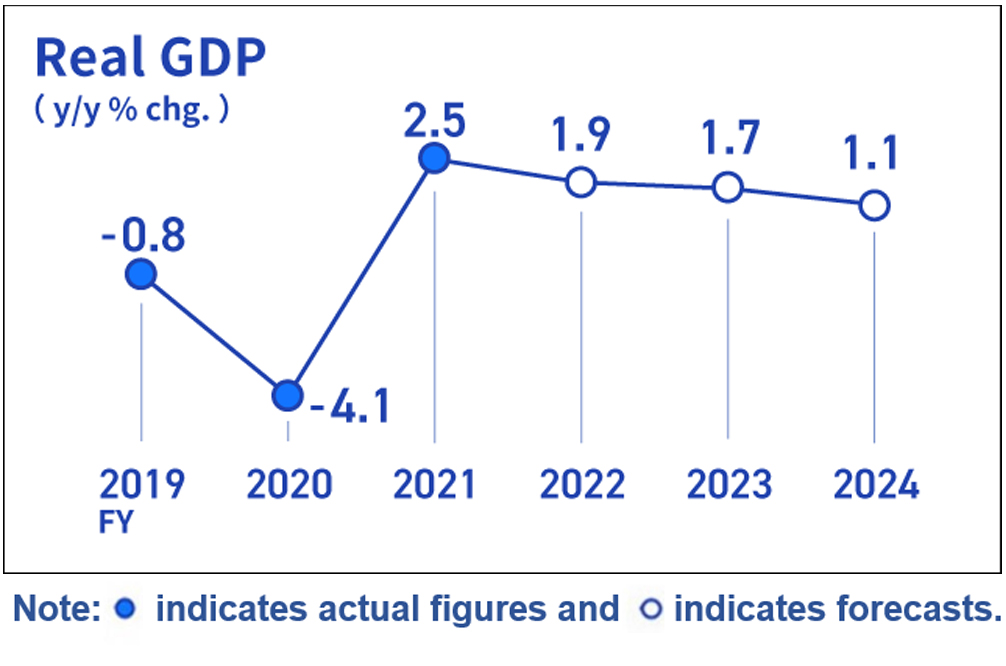

Japan's economy is likely to recover.

Japan's economy is likely to recover, with the impact of COVID-19 on consumption waning and parts procurement difficulties dissipating, although it is expected to be pushed down by high commodity prices and slowdowns in overseas economies.

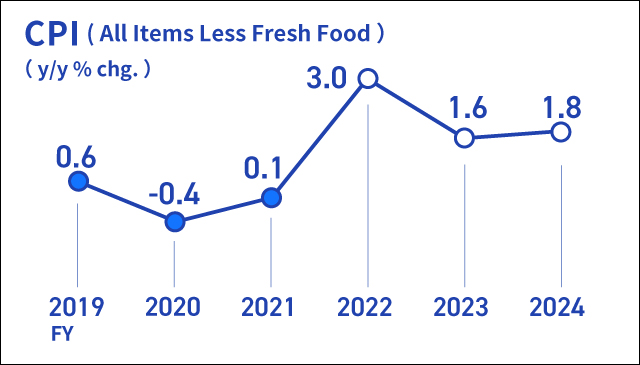

Inflation is likely to be relatively high in the short run and then decelerate.

The year-on-year rate of increase in the CPI is likely to be relatively high in the short run due to the effects of a pass-through to consumer prices of cost increases led by a rise in import prices. The rate of increase is then expected to decelerate toward the middle of fiscal 2023. Thereafter, it is projected to accelerate again moderately on the back of economic improvement and a rise in wage growth.

There are high uncertainties, including developments in overseas economic activity and prices, and market developments warrant attention.

Extremely high risks surround Japan's economy, including the following: developments in overseas economic activity and prices; developments in the situation surrounding Ukraine and in commodity prices; and the course of COVID-19. In addition, due attention is warranted on developments in financial and foreign exchange markets and their impact on Japan's economic activity and prices.

The Bank will continue with powerful monetary easing.

The Bank aims at achieving the price stability target of 2 percent in a sustainable and stable manner. It will support financing, mainly of firms, and maintain stability in financial markets to support Japan's economic recovery from the pandemic.

Policy Board Members' Forecasts

Outlook for Economic Activity and Prices

For further details, please see "The Bank's View" and the full text of the Outlook for Economic Activity and Prices (Outlook Report) on the following pages: