The Securities Settlement System and Distributed Ledger Technology

Kenta Sekiguchi, Makoto Chiba, Mikari Kashima (Bank of Japan)

Research LAB No.18-E-2, June 5, 2018

Keywords: distributed ledger technology; securities settlement; book-entry transfer securities; Act on Book-Entry Transfer of Corporate Bonds and Shares; multi-layered structure

JEL Classification: K22

Contact: makoto.chiba@boj.or.jp

Abstract

Distributed ledger technology (DLT) is attracting wide attention because of the benefits it provides such as fault tolerance and cost reductions. When introducing DLT in securities transactions, its relationship with the Act on Book-Entry Transfer of Corporate Bonds and Shares, which regulates the transfer of paperless securities, should be examined to ensure the stability of securities settlement.

The Bank of Japan's Institute for Monetary and Economic Studies commissioned a series of workshops on the use of DLT in securities settlement and released a report on the findings in 2017 (available in Japanese only). The report presents possible interpretations of current law, which stipulates a multi-layered settlement structure, considering the fault tolerance characteristics of DLT, which enables network participants to share information. Furthermore, the report considers the future shape of the securities settlement system with DLT if legal reforms are taken into account.

Introduction

The Act on Book-Entry Transfer of Corporate Bonds and Shares (hereafter the Act) establishes the paperless settlement system for corporate bonds, stocks, government bonds, etc. (book-entry transfer securities or hereafter simply "transfer securities"). Specifically, it stipulates that the ownership of transfer securities is established by records in a book-entry transfer account register (hereafter "account register") and also sets out the regulations of the book-entry transfer institutions (hereafter "transfer institutions") and account management institutions (AMIs) under the aegis of a transfer institution, which record these transfers.

Distributed ledger technology (DLT) has attracted attention as a technology that may improve the fault tolerance and reduce the costs of ledger management and, in the future, could also be used to record transfer securities. In that case, while one possible option would be to design an optimum legal framework from scratch taking the characteristics of the technology into account, waiting for this may delay the response to innovation. Therefore, the use of DLT under existing law, especially the Act, which establishes the ownership of transfer securities, should be examined first. Such considerations then provide the basis for examining a possible future legal framework.

This article first considers issues related to the use of DLT under the Act and then examines the future shape of the securities settlement system with DLT if legal reforms are taken into account. While DLT can also be used for securities transaction orders and trade execution as well as trade matching and clearing, this article focuses on securities settlement regulated by the Act.

As a starting point, let us provide an overview of the recording structure stipulated by the Act and the assumptions of this article regarding the DLT's technical specifications and the way DLT is used.

The Recording Structure Established by the Act

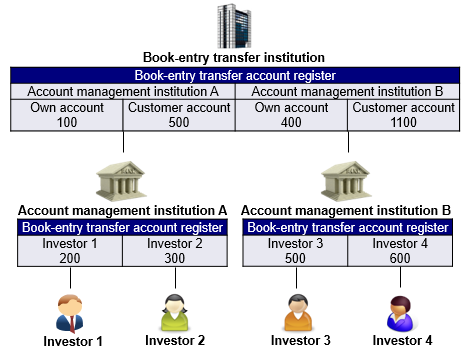

The Act establishes the securities settlement systems based on a multi-layered structure (Figure 1). The transfer institution located at the apex -- the Bank of Japan or the Japan Securities Depository Center depending on the type of securities involved -- in its operational rules stipulates the detailed rules for the settlement of securities under its aegis and sets up accounts for AMIs. AMIs are financial institutions such as banks and securities companies. These AMIs in turn set up accounts for other AMIs and general investors.

In Figure 1, transfer securities held by AMIs A and B are recorded in their respective "own account" in the account register of the transfer institution. Moreover, transfer securities owned by Investors 1 and 2 are recorded in their respective accounts in the account register of A. The transfer institution records the total amount of transfer securities in the accounts that A has set up for investors (that is, the total amount of transfer securities held by Investors 1 and 2) in A's customer account in the account register of the transfer institution. In other words, the transfer institution does not record the transfer securities held by Investors 1 and 2 separately. As a result, in the system established under the Act, information on individual accounts is distributed unevenly between the transfer institution responsible for the type of securities involved and AMIs (hereafter summarily referred to as book-entry institutions: BEIs).

Figure 1: The securities settlement system under the Act

Finality of Settlements and DLT

It is important that the finality of settlements is guaranteed, that is, that settlements are irrevocable and unconditional. For this reason, this article assumes the following DLT setup.

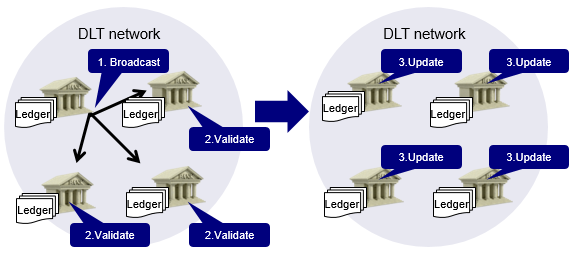

First, a particular network participant broadcasts information (transaction details) to be updated to other network participants. When a certain number of network participants have validated the information, the transaction is fixed. After that, each network participant updates their ledger based on the fixed transaction (Figure 2).1 As a result, all network participants will have the same transaction details.2

Figure 2: Assumed DLT recording process

Thus, whereas the Act envisages information to be distributed unevenly across BEIs, when DLT is used, account information of all investors is shared by all BEIs. As a consequence, the following issues arise under the Act.

- The setup mainly considered here is practical Byzantine fault tolerance (PBFT), in which ledgers are updated once about two-thirds of network participants have validated the information. On the other hand, proof of work (PoW) is a typical example of a setup in which the finality of settlement is not guaranteed due to a so-called fork in the ledger.

- Since the Act stipulates that account registers must be managed by a transfer institution and AMIs, this article also assumes that the DLT network will be comprised of these institutions.

Issues under the Act 3

Is it allowed for each BEI to hold account information of all investors?

As outlined above, whereas the Act assumes that information is distributed unevenly, information is shared across the network when DLT is used. A potential issue therefore is whether such sharing of information is permissible under the Act.

In this regard, there is no provision in the Act that prohibits each BEI from possessing the account information of all investors, and it is likely that the current system was not designed for the purpose of prohibiting this.

However, investors for various reasons do not want details of their portfolios to be widely known. Given such practical needs, encryption of account information or other mechanisms will be necessary so that even if each BEI holds account information of all investors, it can only view the account information of investors that have directly opened an account with it. 4

- 3The report examines additional issues such as the sharing of losses in the case of erroneous records and the supervision and regulation of BEIs.

- 4It should be noted that, based on the Act on the Protection of Personal Information and financial institutions' duty to maintain confidentiality, investors' consent to the sharing of information by BEIs may be necessary even when account information is encrypted.

When do transfers take effect?

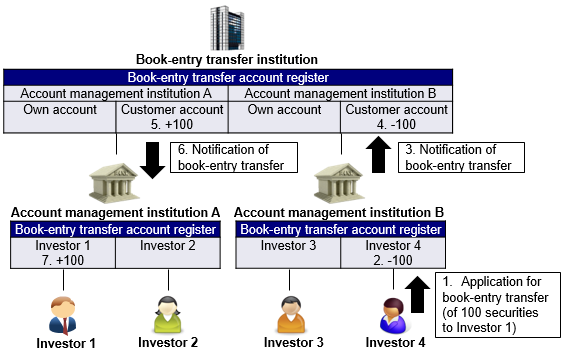

To examine when transfers take effect, let us look at the settlement process established by the Act (Figure 3). Suppose Investor 4 transfers 100 securities to Investor 1. First, Investor 4 files an application for a book-entry transfer to AMI B. Upon receiving the application, B records a reduction of 100 securities in Investor 4's account and notifies the transfer institution of the application. Upon receiving the notification, the transfer institution records a reduction of 100 securities in B's customer account and an increase of 100 securities in A's customer account, and notifies A of the application. Finally, A will record an increase of 100 securities in Investor 1's account. The Act stipulates that the transfer will take effect when the increase is recorded in the account of Investor 1, the recipient of the book-entry transfer. Thus, under the Act based on the premise that each BEI holds information only of those that directly hold an account with it, information is transmitted in a notification relay among BEIs.

Figure 3: Settlement process under the Act

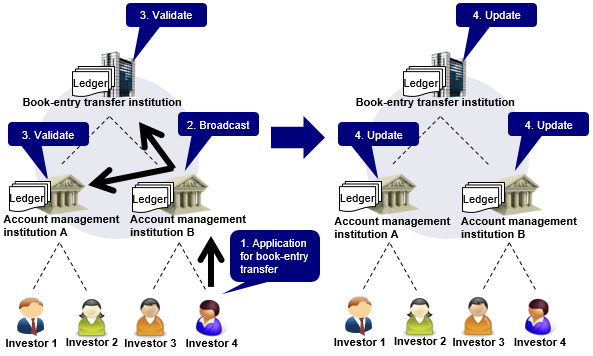

When DLT is used, the settlement process is as shown in Figure 4. First, Investor 4 files an application for a transfer to B. Upon receiving the application, B generates a transaction to transfer 100 securities from Investor 4 to Investor 1 and broadcasts this information to other BEIs through the DLT network. The other BEIs validate the transaction. When a certain number of validations have been obtained, each BEI updates its ledger accordingly. Thus, unlike in the process envisaged by the Act, each BEI will record an increase for Investor 1 and a reduction for Investor 4.

Figure 4: Settlement process based on DLT

This raises the question at which point in time -- that is, when which BEI updates its ledger -- a transfer takes effect.

Under the Act, based on the premise that information is distributed unevenly, there is only one BEI providing and maintaining the records of the recipient's account. In Figure 4, the only AMI providing an account for Investor 1, the recipient, is A. Therefore, it could be considered that even when DLT is used, the moment when A records the transfer continues to be the point in time when the transfer from Investor 4 to Investor 1 takes effect.

On the other hand, given that with DLT information is shared among network participants, one could also regard the transfer to take effect when other BEIs record an increase in Investor 1's account in their ledgers. In this case, even if A cannot update its ledger due, for example, to a computer system failure, the transfer from Investor 4 to Investor 1 can take effect. This approach therefore would exploit the fault tolerance of DLT.

To adopt this approach, A can entrust record-keeping activities to other BEIs in advance so that their records can be regarded as records created on behalf of A. To make it possible for accounts of all investors to be handled in this way, it would be necessary for all BEIs to mutually entrust record-keeping responsibilities to each other. In this regard, the Act states that a BEI may be approved by the competent minister to entrust another person with a part of its book-entry transfer services. However, some interpret the Act as disallowing entrustment of the core of book-entry transfer services. Based on this interpretation, entrustment of record-keeping activities may not be permitted, since the keeping of records constitutes the core of book-entry transfer services. In this case, to better exploit the fault tolerance of DLT, a revision of the Act may be necessary.

Further, using DLT in the record-keeping process makes it possible to shorten the notification procedure envisaged in the Act. For example, the notification from the transfer institution to A shown in Figure 4 becomes obsolete. That is, if the notification duties in the Act are interpreted such that the transfer institution is allowed to entrust the transfer notification to B, the notification duty falling on the transfer institution can be regarded as having been fulfilled by the broadcasting of the transaction conducted by B.

Possible Securities Settlement System Offered by DLT

The considerations so far have taken the Act as given. Next, prospects for a possible settlement system using DLT when going beyond the current provisions of the Act are examined.

The Act establishes the securities settlement system based on a multi-layered structure, in which each investor or AMI sets up an account with the BEI in the tier immediately above. However, this structure is not necessarily required when using DLT, where information is shared and each BEI holds the account information of all investors. For example, it is possible to set up a system in which an investor can file an application with any BEI.

In this case, the securities settlement system would not be characterized by a multi-layered structure with a transfer institution at the apex; instead, all network participants would be equally connected. However, whether this would make having a central administrator like a transfer institution obsolete is a separate issue.

For example, the current roles of a transfer institution include stipulating rules for the securities settlement system in their operational rules and addressing any violations of these rules by AMIs. Such entities setting and administering governance rules will still be required when DLT is used. Moreover, if the account information accessible to individual network participants is restricted, it may be necessary to have an authorized network participant that can grasp and manage information of all accounts on behalf of individual network participants. These roles could be fulfilled by the current transfer institution or by other entities (such as a consortium of network participants).

Conclusion

DLT is expected to continue to further develop and become more widespread. Utilizing this new technology may make the securities settlement system more stable and more efficient; at the same time, the introduction of new infrastructure may create new risks. Thus, to exploit the benefits of this constantly evolving technology while managing its risks, it is important to thoroughly examine both the technological and legal issues involved.

Reference

- Report of Workshops on "The Use of Distributed Ledger Technology in Securities Settlement" (2017), to be included in Kin'yu Kenkyu (Monetary and Economic Studies), Institute for Monetary and Economic Studies, Bank of Japan (forthcoming 2018) (available in Japanese only).

Note

The views expressed herein are those of the authors and do not necessarily reflect those of the Bank of Japan.